LAHORE March 18: Pakistan on Friday obtained $500 million as the second payment from the $1.3 billion facility provided by the Industrial and Commercial Bank of China (ICBC).

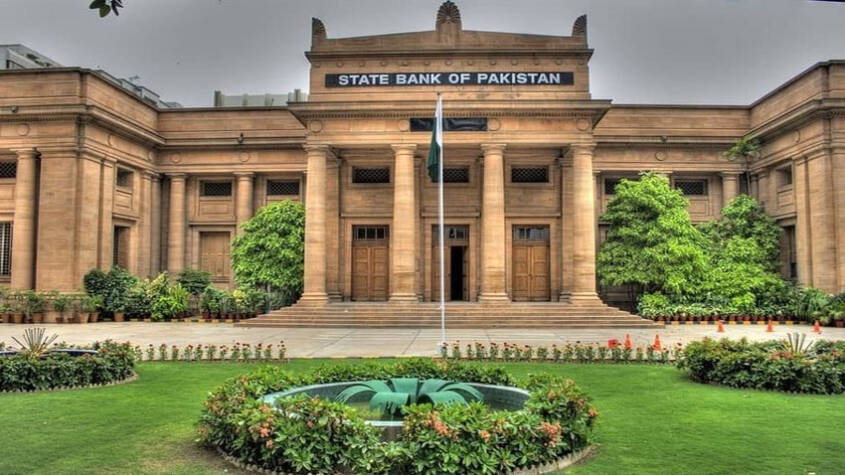

Senator Ishaq Dar, the Federal Minister for Finance and Revenue, shared the news on Twitter, stating that the State Bank of Pakistan has received the payment in its account, which will enhance Pakistan’s foreign exchange reserves.

This disbursement was made after Pakistan fulfilled the required documentation.\On March 4, ICBC had approved a rollover of a $1.3 billion loan for Pakistan. At the time, Dar said the facility would be disbursed in three instalments, with the first instalment of $500m received by the central bank.

This brings the total of commercial loans up to $1.7 billion out of the total committed amount of $2 billion. Pakistan is currently undergoing a massive liquidity crisis due to a constantly delayed IMF programme.

A day earlier, finance minister Ishaq Dar had admitted that the Fund was asking for the materialisation of commitments made by ‘friendly countries’ with Islamabad, which remains the “only delay” in resumption of the stalled programme.

Speaking during the Senate’s session on Thursday, Dar said: “At the time of previous reviews, certain friendly countries made commitments to bilaterally support Pakistan. But the IMF is now asking that they should actually complete and materialise those commitments.”

“That’s the only delay,” the finance minister told the Senate.

The State Bank of Pakistan (SBP) received $500 million last week from the Industrial and Commercial Bank of China (ICBC) just days after it had received $700 million from the China Development Bank. The upcoming refinanced loan of $500 million would bring the total of commercial loans to $1.7 billion out of the total committed amount of $2 billion.

Now, Pakistani authorities are anxiously waiting for confirmation from other ally countries like Saudi Arabia, UAE, and Qatar, as well as from the World Bank and the Asian Infrastructure Investment Bank, for fulfilling the external financing needs of $6 billion until the end of June 2023.

The IMF team left Pakistan on the 9th of February without signing a staff level agreement, since when the government has been scrambling to meet the fund’s demands and get the vital $1.1 billion released. On February 11th, the government bulldozed a mini-budget through the national assembly to placate the IMF and agreed to impose Rs 170 billion in additional taxes to meet the fund’s conditions.

In the meantime the government has been trying to receive loans from friendly countries to try and shore up forex reserves and avoid default. Pakistan has previously received a $700m loan from China to help in this regard.