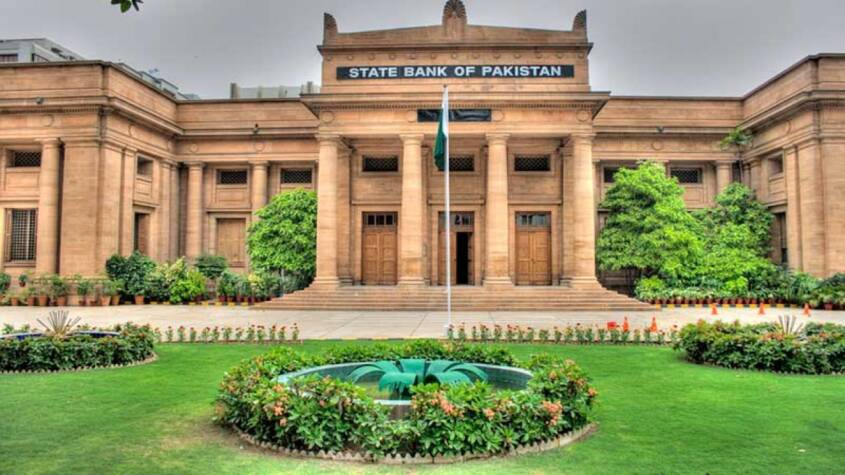

KARACHI: The inflows of foreign direct investment (FDI) in May jumped by 63 per cent to $198.3 million compared to $121.4m in the same month last year, the State Bank of Pakistan (SBP) said on Friday.

The increase of about $77m in FDI could be a harbinger of positive change, given that slow growth was observed over the past few years.

According to the latest SBP data, this year April was good compared to the same period in FY20. However, the month of May proved to be even better as the inflows increased by 25.5pc compared to $158m in April, highlighting a positive trend.

The overall inflows during July-May (11MFY21) witnessed a decline of 27.7pc. The country received total FDI worth $1.752bn during the period against an inflow of $2.423bn.

The external front of the economy is presently in a better shape since the current account is in surplus while the SBP reserves are at a four-year high.

This gives an attractive picture to the foreign investors. The government is also providing a number of incentives to the foreign investors.

Analysts said the outgoing fiscal year was fully dominated by the uncertainties due to the Covid-19 pandemic which discouraged investors from spending.

The FDI in 11MFY21 — so far at $1.751bn — surpassed total $1.362bn inflows in FY19.

China remained the largest investor in Pakistan but the inflows were less than the previous year. The SBP data showed that the FDI in 11MFY21 from China was $728m compared to $843m in 11MFY20.

Hong Kong was the second largest investor during this period as its investment increased to $138m but was less than the previous year’s investment of $168m.

The collective investments from China and Hong Kong were $864m during this period — almost 49pc of the total inflows.

Other significant amount of FDI included $130.5m from the UK, 105.7m from the US and $116m from the Netherlands.

During 11MFY21, a major investment of $856m came in the power sector, followed by $227m in the financial business sector and $206m in the oil and gas explorations sector.

The total foreign private investment, which included portfolio investment, noted a decline of 32.8pc during 11MFY21.

The outflow of portfolio investment amounted to $285m compared to $238.5m during the same period in FY20.

Despite low FDI, the country paid $10.6bn as debt servicing during the nine months of the current fiscal year while it maintained foreign exchange reserves at four-year high with the help of record inflow of remittances and some improvement in the exports sector.